Green Roof Tax Incentives: Cultivating Savings

Investing in a green roof for your property not only contributes to environmental sustainability but can also lead to significant financial benefits through tax incentives and improved energy efficiency.

Understanding Green Roof Tax Benefits

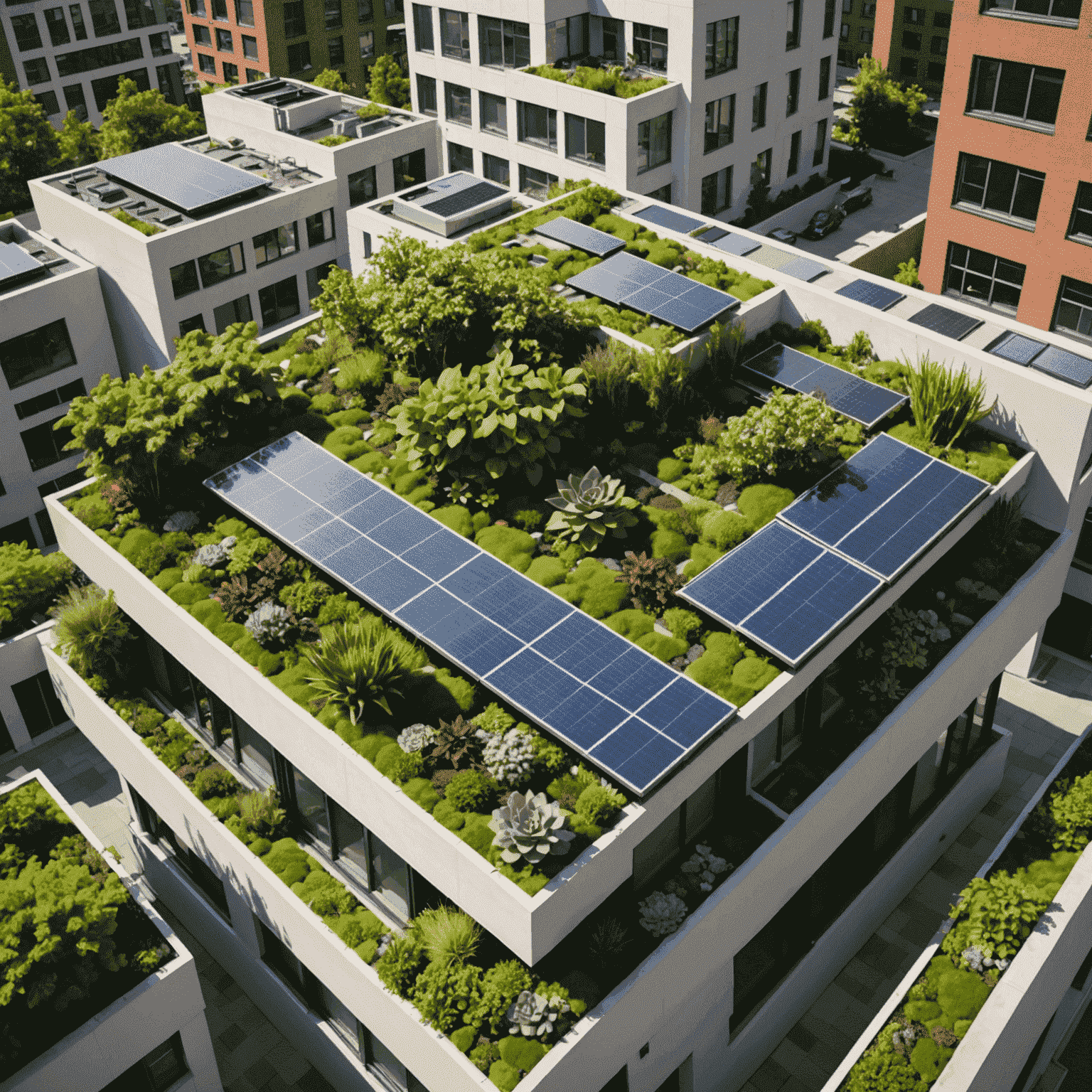

Green roofs, also known as living roofs or eco-roofs, are becoming increasingly popular in urban areas. These innovative installations offer a range of benefits, from reducing urban heat islands to managing stormwater runoff. What many property owners may not realize is that installing a green roof can also lead to substantial tax savings.

Municipal Rebates and Incentives

Many Canadian municipalities offer rebates and incentives for property owners who install green roofs. These programs are designed to encourage sustainable building practices and can significantly offset the initial installation costs. For example:

- Toronto's Eco-Roof Incentive Program offers up to $100 per square meter for green roof installations.

- Vancouver provides a $10 per square foot grant for residential green roofs.

- Montreal offers tax credits of up to 50% of eligible green roof installation costs.

It's essential to check with your local municipality to understand the specific incentives available in your area.

Federal Tax Credits

While there isn't a specific federal tax credit for green roofs in Canada, these installations may qualify under broader energy efficiency programs. The Canada Greener Homes Grant, for instance, offers up to $5,000 for energy-efficient home improvements, which could include green roof installations that contribute to better insulation and energy performance.

Energy Efficiency and Long-Term Savings

Beyond direct tax incentives, green roofs offer long-term financial benefits through improved energy efficiency:

- Reduced heating and cooling costs due to improved insulation

- Extended roof lifespan, potentially doubling the life of your roof

- Increased property value, which can lead to tax benefits if you sell your home

How to Claim Your Green Roof Tax Benefits

- Research local and federal incentive programs applicable to your area.

- Consult with a tax professional or green building expert to understand eligibility requirements.

- Keep detailed records of all expenses related to your green roof installation.

- Obtain necessary certifications or energy audits to support your claims.

- Include relevant deductions or credits when filing your taxes.

By taking advantage of these tax incentives and energy savings, you can make your green roof investment even more rewarding. Not only will you be contributing to a more sustainable future, but you'll also be cultivating significant savings for years to come.