EV Charging Stations: Home Installation Tax Perks

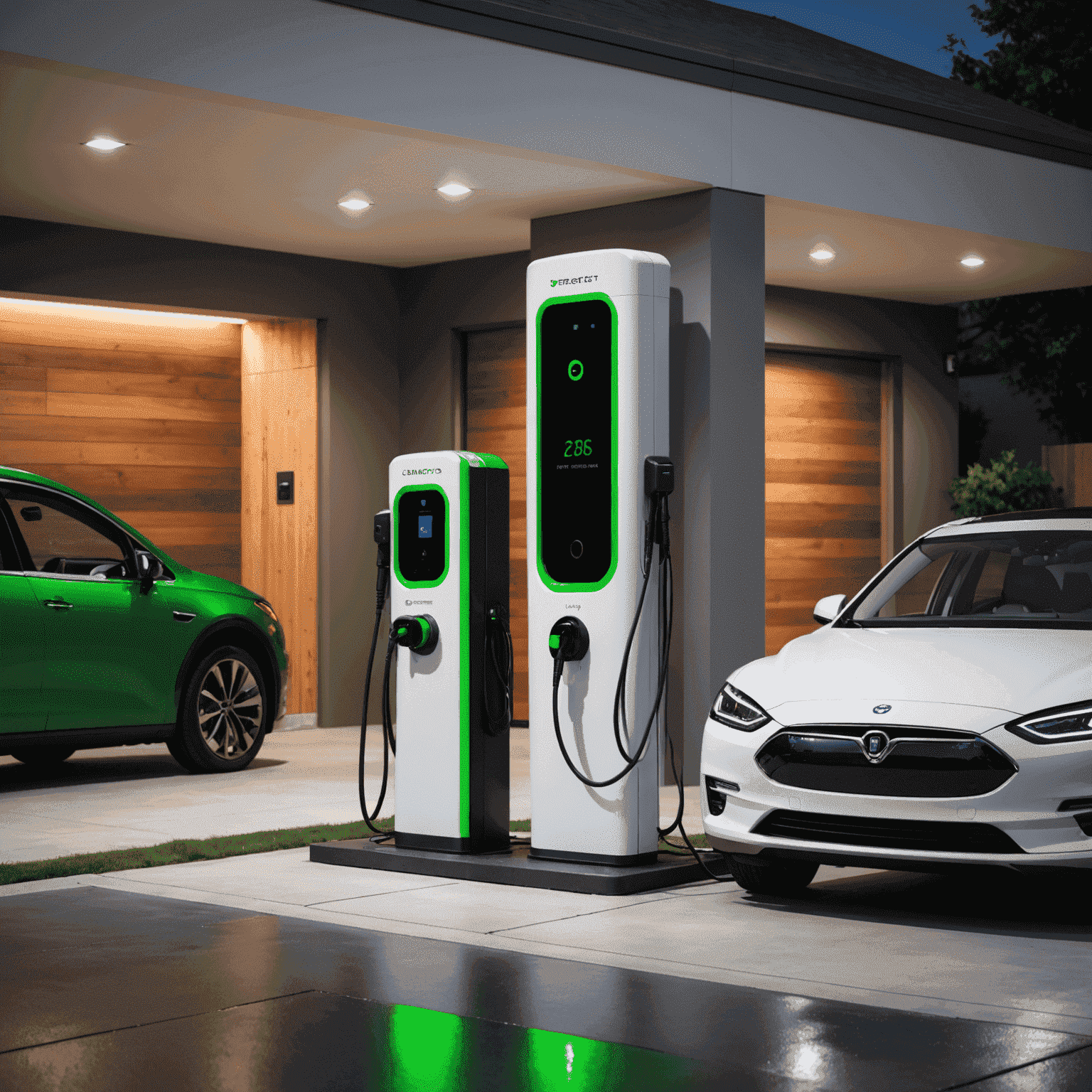

As Canada pushes towards a greener future, homeowners are discovering the financial benefits of installing electric vehicle (EV) charging stations. Not only does this upgrade contribute to reducing carbon emissions, but it also opens the door to valuable tax incentives.

The Green Advantage

Installing an EV charging station at your residence is more than just a convenience for electric car owners. It's a step towards sustainable living that the government is eager to support through various energy incentives and tax credits.

Available Tax Credits

Homeowners can benefit from federal and provincial tax credits when they install EV charging stations. These credits can significantly offset the initial installation costs:

- Federal EV Charger Tax Credit: Up to 30% of the cost, maxing out at $1,000

- Provincial Incentives: Vary by province, with some offering additional rebates of up to $700

- Municipal Programs: Some cities provide extra incentives for residential green energy upgrades

Long-Term Savings

Beyond immediate tax benefits, home EV charging stations can lead to significant long-term savings:

- Lower Fuel Costs: Electricity rates are generally more stable and lower than gasoline prices

- Increased Property Value: Homes with EV chargers are becoming more desirable in the real estate market

- Reduced Maintenance Costs: Electric vehicles typically require less maintenance than traditional cars

Environmental Impact

By installing a home EV charging station, you're not just saving money – you're contributing to a cleaner environment:

- Reduced Carbon Footprint: EVs produce significantly fewer emissions than gas-powered vehicles

- Support for Renewable Energy: Many utility companies offer programs to charge your EV with renewable energy

- Encouraging EV Adoption: Your installation can inspire neighbors and visitors to consider electric vehicles

How to Get Started

To take advantage of these tax perks and contribute to a greener Canada:

- Research available incentives in your area

- Consult with a certified electrician for installation options

- Keep all receipts and documentation for tax filing

- Enjoy the benefits of convenient, cost-effective, and eco-friendly charging at home

Remember: Tax laws and incentives can change. Always consult with a tax professional or visit the official Canada Revenue Agency website for the most up-to-date information on tax credits for residential green energy upgrades.